Background

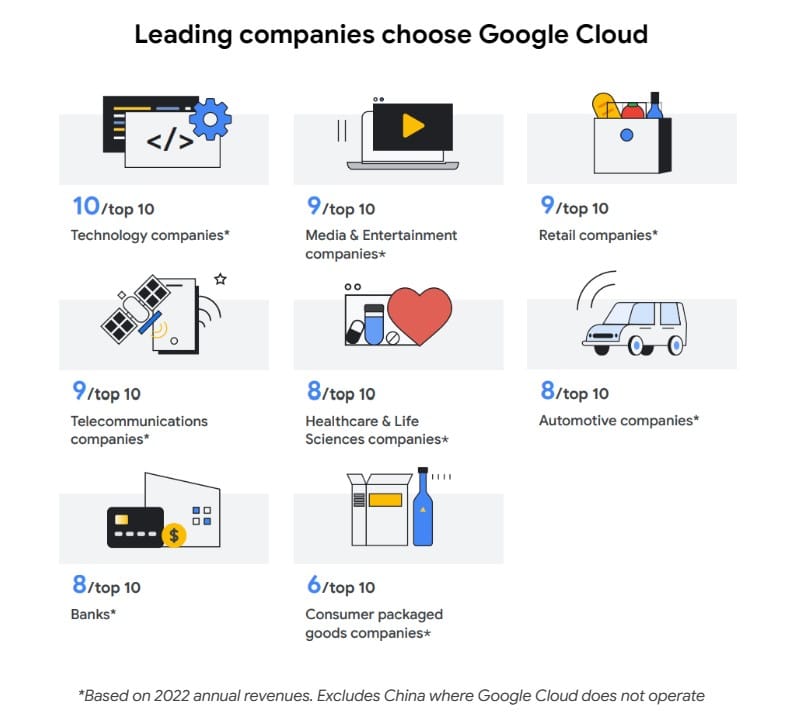

In the just concluded Google Next conference, Google announced several new cloud services aimed at enterprise customers. Given the market size and Google’s share of the pie, this focus on enterprise customers is understandable. According to a recent report by IDC, Google’s market share lags far behind Amazon Web Services and Microsoft Azure in the foundational cloud services and Cloud-delivered (SaaS) applications market. Although Google Cloud revenues were up 28% YoY in Q2 2023, and a significant percent of enterprises in each industry use Google Cloud (see Figure 1 below), its challenge is gaining a solid foothold in the enterprise market, translating to a higher market share.

With this backdrop, Google Cloud made a series of announcements with new and improved service offerings aimed at corporate customers at the conference. Here are some observations from the new offerings Google shared with industry analysts.

Partner Adoption: Vertex AI was announced as Google Cloud’s Generative AI solution a few months ago in response to the rapid popularity growth of OpenAI. With the addition of Meta’s LLaMA 2 and Anthropic’s Claude 2, Vertex AI now has a wide range of curated models. SAP uses customer data with Vertex AI as a platform to deliver industry solutions for customers. DocuSign is building a pilot solution using Vertex AI to enable users to ask natural questions about contracts and documents. Workday uses Google Cloud Gen AI to help generate job descriptions via the skills API in Workday Extend.

While getting partners to adopt Vertex AI is a sign of success for Google Cloud, these partnerships are not exclusive, as partners include offerings with competing cloud vendors. Google would need to continue to innovate with Vertex AI while differentiating in the market with price and Quality of Service (QoS) to make inroads in the corporate cloud segment.

Enterprise Implementations: There were many industry-specific offerings announced from enterprise customers, including GE Appliances, IHOP, and Six Flags. These offerings include Bayer and HCA delivering healthcare-specific offerings with Med-Palm2, a medically tuned LLM. Customer and partner examples indicate that Google Gen AI products are being implemented successfully and providing business value to enterprises.

These offerings from enterprise customers are encouraging, particularly given the use of Google AI offerings in developing these industry and domain-specific solutions. Google will have to accelerate such adoption to gain momentum and market share.

Silicon Investment: Google has used purpose-built infrastructure for its AI computing needs, powering services like Gmail and YouTube, serving billions of users. Google now allows customers to leverage its tensor processing units, TPU v5e, to accelerate training and inference workloads. TPU v5e supports integration with Google Kubernetes Engine (GKE), Vertex AI, and leading frameworks such as PyTorch, JAX, and TensorFlow, making deploying their AI projects easier. Google also partners with NVIDIA to offer H100 GPUs for large-scale AI models. With TPU v5e and software integration, Google Cloud provides customers with a more scalable and cost-effective full-stack AI solution.

Google announced TPU in 2016 for machine learning workloads and has been consistently improving the offering. If TPU delivers faster processing of AI workloads, this silicon innovation will increase customer adoption.

Collaboration Cloud: Google Workspace claims to have 10+ million paying organizations. This number includes solopreneur organizations, like RobustCloud.com, that have been using Workspace for free since its launch but had to pay at the beginning of 2023. A large subset of these customers could be tiny customers vs. large enterprises.

Google offered several productivity tools powered by Duet AI, including creating presentations through prompts and note-taking during meetings. It has provided explicit assurances that it will not use client data to train models now or in the future without specific approval.

Google’s collaboration offerings have significant market reach and could be a key differentiator as Google looks to generate revenue from these offerings. Enterprises may find the value of privacy as a differentiating feature to prefer Google collaborative offerings over competitors.

Developer tools: Duet AI became available in beta at the Google I/O event earlier this year. At the Google Next conference, Google broke up developer productivity features that assist in application modernization, context-aware code generation, and application integration. Google announced a set of pre-built solutions to help developers get a jump start to building solutions for their organization.

While all these features are promising, the fact that they are still in preview mode may be a barrier to adoption by enterprises. Google must move quickly, make these tools generally available, and incentivize client adoption through a freemium model.

Summary:

Google needs to ensure some of the key offerings in the preview mode are quickly available as production-ready (GA) and are ready for client adoption. For example, the Vertex AI demonstration at the Google Next event featured basic capabilities that may not move the needle for adoption by corporate clients.

As SaaS providers deliver value to their customers, Google can capitalize on clearly articulating the value of its AI solutions. Google needs to grow its partnerships with SaaS providers such that they are including Google AI offerings in their solutions as a primary choice.

Vendors need a solid sales and technical team to penetrate the enterprise market to guide customers. For higher enterprise revenues and increased market share, Google must strengthen internal teams and reach customers through better partnerships with systems integration vendors.

Overall, the Google Cloud announcements made at the Google Next conference are a step in the right direction in attracting more enterprise clients.

Ram Viswanathan, Consultant and ex-IBM Fellow, contributed to this blog post.