IBM held its annual conference in May in Boston. After listening to the keynote recordings, here are some observations on IBM’s strategy. This piece also provides a brief perspective on IBM Quantum Starling (see Figure 1 below), which was announced on June 10th. The IBM Think keynote session was divided into discussions about IBM’s portfolio and talks with two customers. The following are some key observations about IBM’s overall strategy.

1. Highlights: The keynote emphasized three shifts:

a. Artificial Intelligence (AI) – Unlocking productivity

IBM’s Watson initiatives were leading a few years ago, but it failed to capitalize on its lead, especially in Watson Health. Despite IBM’s early success, such as the iconic Jeopardy! win, its healthcare applications fell short, resulting in billions of dollars in losses. This type of failure highlights the challenges that large legacy tech firms face in delivering market-ready solutions.

On the bright side, IBM is now positioning AI to unlock productivity across industries, adopting a different approach compared to Watson when it tried to provide accurate results to oncologists.

b. Hybrid Cloud: The hybrid cloud market leverages IBM’s traditional enterprise IT strength for businesses that are not ready to migrate to the cloud entirely. While IBM has the basic infrastructure and enterprise relationships, its ability to differentiate and effectively integrate across hybrid environments is limited. IBM lacks a sufficient public cloud presence to compete head-to-head with the hyperscalers in the hybrid space. In an era of cloud native solutions, competing against hyperscalers presents a significant challenge.

c. Quantum: IBM had an interesting perspective in comparing AI with quantum computing. Arvind Krishna stated that AI learns from the past, while quantum computing tries to predict the future, for example, by understanding how molecules react. IBM noted that it built 75 quantum computers, with access available to thirteen of them via the cloud. Two are installed in customer locations, one at RIKEN and another at the Cleveland Clinic.

However, quantum computing is still very much in its infancy. While the potential for quantum to revolutionize industries like pharmaceuticals exists, the market is still years away from quantum systems becoming practical for most industries. Quantum is far from the immediate returns that IBM is likely hoping for in its AI and hybrid cloud efforts.

Comments: IBM’s strategy — AI, hybrid cloud, and quantum computing — showcases its efforts to remain relevant in an era of cloud and AI transformation. The company’s legacy and its long-standing relationships with enterprise clients give it a certain level of credibility, but its actual differentiators are unclear at this point. With hybrid cloud, it’s in a competitive race with hyperscalers, and its quantum efforts are still years away from realizing practical business value. To remain competitive, IBM must refocus on its AI efforts to avoid repeating the mistakes of Watson’s past and ensure that it delivers on its promises of productivity.

IBM has innovated in several areas, such as RISC hardware, database technology, and personal computers, only to see other companies implement the technology for customers more effectively than IBM. With the benefits of quantum computing years away, every competitor can narrow the gap and eventually win the battle for customers.

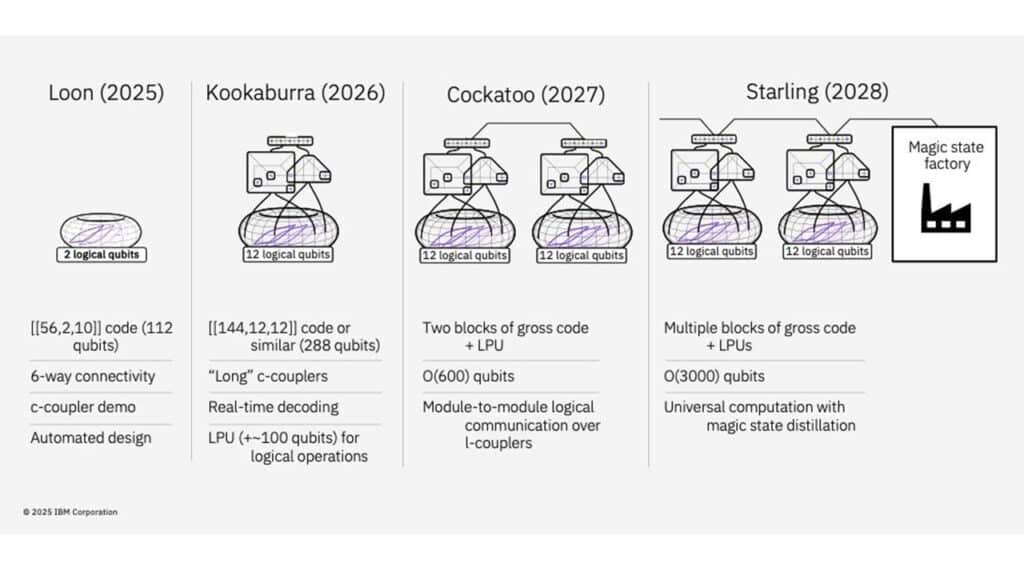

With the IBM Quantum Starling announcement, IBM appears to have a lead in quantum computing, and tangible results are expected with the planned deployment in 2029. With the scheduled timeline of delivering the first modular, fault‑tolerant quantum system at scale, IBM can potentially change the competitive quantum field by solving real-world problems.

2. Open Source Software: At the conference, IBM reiterated its commitment to open-source AI and hybrid cloud solutions. IBM highlighted the open innovation in AI development through its collaboration with Meta. Additionally, IBM showcased its acquisition of HashiCorp, providing customers with a unified operating model for managing hybrid environments for infrastructure provisioning and secrets management.

Comment: IBM introduced HashiCorp as a tool to provide customers with a unified operating model for managing hybrid environments. Red Hat’s hybrid leadership seemed to take a backseat, overshadowed by the more prominent mentions of Meta and HashiCorp.

Considering its openness, IBM should reconsider its ongoing lawsuit against the Linux Foundation (initiated by HashiCorp). IBM itself was previously the target of SCO Linux, which should serve as a valuable experience. As a result of the lawsuit, IBM (and, by association, Red Hat) are perceived as a hurdle to community innovation.

3. Consulting: IBM’s consulting unit was featured in customer stories at the keynote. Customers with a shortage of talent require systems integrator skills to adopt emerging technologies for business transformation. IBM consulting customers typically have a cultural affinity for IBM’s product portfolio for decades and are mostly unable to handle the complexity with in-house skills.

Comment: IBM’s differentiator over the years has been its “consulting” unit. What differentiates them, and how can they deliver successfully? Unfortunately, IBM Consulting has not particularly excelled in this area, given the stiff competition from companies like Accenture and Tatas. While hyperscalers are thriving on systems integrator partnerships, IBM Consulting becomes a barrier to IBM’s partner success, as IBM Consulting frequently competes with systems integrators. Another barrier for IBM Consulting’s growth is that several companies, particularly in the highly competitive financial services and retail industries, are investing in their in-house technical capabilities, thereby reducing their need for large-scale IBM Consulting services.

Summary: While IBM outlined its strategic focus on artificial intelligence, hybrid cloud, and quantum computing, it needs to bring its differentiating capabilities in the first two to market quickly and establish a leading position in Quantum. Although IBM is taking a more grounded and productivity-driven approach to AI after past missteps with Watson, it faces tough competition in hybrid cloud from hyperscalers and lacks clear differentiation. Its quantum computing investments, underscored by the Quantum Starling announcement and a 2029 deployment goal, position IBM as a leader in a field still years from commercial viability. IBM also emphasized open-source collaboration through partnerships with Meta and the acquisition of HashiCorp, though it notably downplayed Red Hat’s role. Meanwhile, IBM Consulting continues to struggle with differentiation, especially as enterprises shift toward in-house capabilities and prefer more agile partners.

Overall, IBM has all the ingredients needed to become an “essential company” again; it will need to utilize them in the right proportion to make a comeback, turning its vision into market leadership.